Learn how to invest in inflation-indexed bonds and protect against inflation.

ARTICLE TABLE OF CONTENTS (Skip to Section)

What Are Inflation-Indexed Bonds

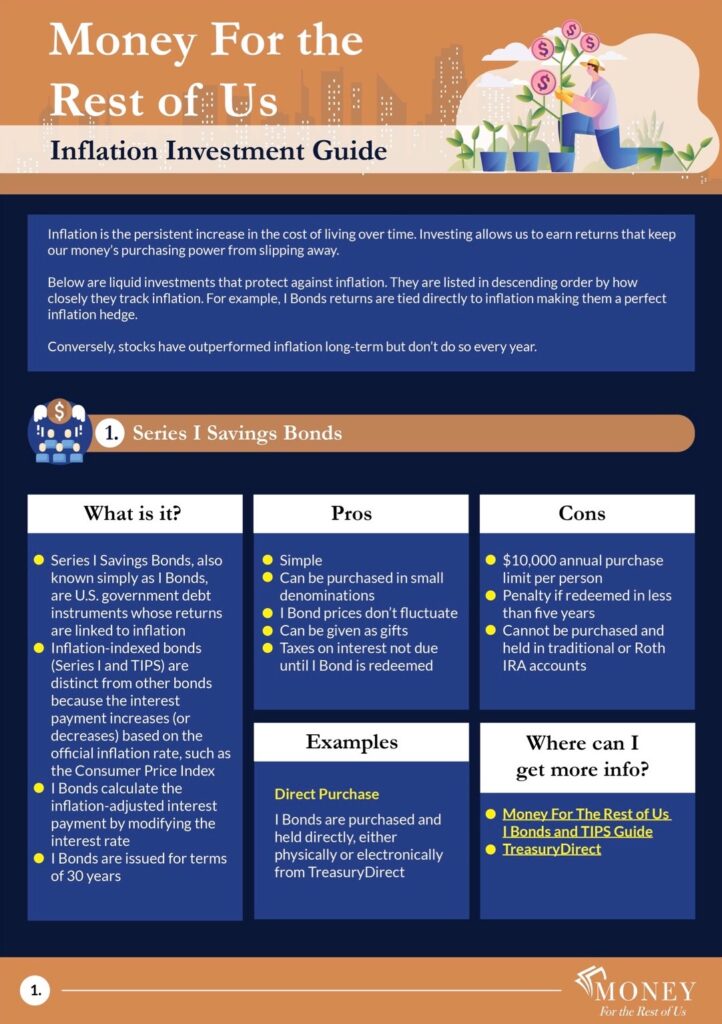

Investing in Series I Savings Bonds

I Bond Term and Early Redemption

I Bonds Denominations, Purchase Limits, and Taxes

I Bonds Interest Calculation

When to Purchase an I Bond

Series I Savings Bonds Pros and Cons

Investing In Treasury Inflation-Protected Securities

TIPS Terms and Denominations

What Are Inflation-Indexed Bonds

Inflation measures the rise in prices over time. The more prices for food, housing, clothes, healthcare, and other goods and services increase, the greater the rate of inflation. In the United States, the Consumer Price Index is the official inflation measure.

Inflation-indexed bonds are debt instruments whose returns are linked to inflation. Inflation-protected bonds are also called inflation-linked bonds or ILBs.

The two inflation-indexed bond types issued by the U.S. government are Treasury Inflation Protected Securities, also known as TIPS, and Series I Savings Bonds.

A bond is a debt instrument issued by governments, corporations, and other entities to raise money to fund new projects or ongoing operations. Most bonds pay interest that is calculated based on a principal value. When the bond matures, the investor receives the principal value.

Inflation-indexed bonds are distinct because the interest payment increases (or decreases) based on the official inflation rate, such as the Consumer Price Index. These adjustments make inflation-indexed bonds an attractive vehicle for protecting against inflation.

Inflation-indexed bonds, such as TIPS and I bonds, are the most direct way to protect a portfolio from the impact of inflation.

Some inflation-index bonds, such as Series I Savings Bonds, calculate the inflation-adjusted interest payment by modifying the interest rate. Other inflation-indexed bonds, such as TIPS, calculate the inflation-adjusted interest payment by modifying the principal value of the bond.

Some inflation-indexed bonds can only be bought directly from the government when they are issued. Other inflation-indexed bonds are available in the secondary market using an online brokerage account. Investors can also invest in mutual funds or ETFs that own inflation-indexed bonds.

To learn more about what causes inflation, check out A Complete Guide to Understanding and Protecting Against Inflation

Investing in Series I Savings Bonds

Series I Savings Bonds, also known as I bonds, can only be bought directly from the U.S. Treasury Department. They are not bought and sold in the secondary market. The bonds are available electronically or in paper form, and were first issued in 1998. The TreasuryDirect website is the easiest place to buy these bonds.

I Bond Term and Early Redemption

I bonds are issued for a term of 30 years. Although I bonds cannot be sold to other investors, they can be redeemed early after holding them for one year. There is an early redemption penalty consisting of three months of interest if the I bond is redeemed during the first five years after purchase. Electronic I bonds can be redeemed through the TreasuryDirect website. Investors can redeem paper I bonds at banks and credit unions.

How To Buy I Bonds, Purchase Limits, and Taxes

The minimum purchase amount for electronic I bonds is $25 while the minimum for paper I bonds is $50. An individual investor can annually purchase $10,000 in electronic bonds or $5,000 in paper bonds. Investors can purchase an additional $5,000 per year in I bonds by taking advantage of a program sponsored by the IRS to purchase I bonds with tax refunds. These purchase limits are per individual so a married couple can purchase $20,000 annually through TreasuryDirect using two separate accounts.

Investors can purchase electronic bonds in any denomination amount above $25 in increments of one penny up to $10,000. Paper I bonds are available in $50, $100, $200, $500 and $1,000 denominations.

Most investors will find it more convenient to purchase electronic bonds via Treasury Direct, but paper I bonds are handy for giving as gifts.

It takes just a few minutes to set up an account on TreasuryDirect. The account is linked to your checking or savings account. After you select an I bond or other savings bond, TreasuryDirect pulls the funds from your bank. You can purchase an I bond on the same day you open your TreasuryDirect account.

Interest on I Bonds is taxable at the federal level, but the interest is exempt from state and local taxes. Interest can be exempt from federal taxes if used for qualifying higher education expenses. I bond holders do not have to pay taxes on the interest until the bond matures or is redeemed.

Video Tutorial On Opening a TreasuryDirect Account and Purchasing a Series I Savings Bond

I Bonds Interest Calculation

The U.S. Treasury calculates the semi-annual interest payment on I bonds by combining the fixed interest rate when the bond was issued and a variable inflation rate. The two rates are combined to form a composite rate, also known as the earnings rate. The inflation rate on I bonds is adjusted every six months based on the change in the non-seasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U). The fixed-rate for a specific I bond will never change over its life, but the U.S. Treasury reviews and potentially adjusts the fixed rate for new I bonds every six months.

The composite or earnings rate will never go below zero, which is an advantage that I bonds have over Treasury Inflation Protection Securities, which can have negative interest rates.

The I bonds earnings rate can fall below the fixed rate on the I bond if CPI was negative due to a period of falling prices or deflation, but the overall composite rate can never fall below zero.

Semi-annual interest payments are not distributed to the bondholder but are added to the principal value of the bonds. Both principal and interest are paid out when the bond is redeemed. Because the interest is not immediately distributed to bondholders, there is a compounding effect as Series I Savings bondholders earn interest on previously earned interest.

When to Purchase an I Bond

The U.S. Treasury changes the inflation rate component of I bonds every May and November. Since that rate is based on CPI-U inflation rate for the previous six months, investors can estimate what the new inflation rate component will be several weeks before it is officially announced.

Investors who purchase a new I bond in May and November will get the new composite rate that reflects the updated inflation assumption that takes effect May 1 or November 1, respectively.

Investors who purchase a new I bond in April or October will get the “old” composite rate for the first six months of ownership, and then in the second six months of ownership, the holder will get the composite rate that was announced a month after the I bond was purchased.

For example, the combined interest rate earned for the first six months of Series I Savings bond ownership for those bonds purchased between November 2021 and April 2022 is 7.12%. The new composite rate for I bonds purchased between May and November 2022 is expected to be 9.62%, based on the March 2022 Consumer Price Index release.

An investor who purchased the I bond in April 2022 will earn the 7.12% composite interest rate for the first six months and in the subsequent six months the holder will earn the new composite rate that will be announced in May 2022. With that rate expected to be 9.62%, purchasing an I bond in April 2022 will guarantee that the purchaser will earn over 7% for an entire year.

Even though the new composite rate is unknown, investors are still better off not waiting to purchase I bonds as all holders will earn the composite rates of interest that is in effect at the time the I bond is purchased and all subsequent composite interest rates announced after the I bond is purchased.

Historical Composite Interest Rate for I Bonds

| FROM | THROUGH | COMPOSITE RATE |

|---|---|---|

| Nov-2024 | May-2025 | 3.11% |

| May-2024 | Nov-2024 | 4.28% |

| Nov-2023 | May-2024 | 5.27% |

| May-2023 | Oct-2023 | 4.30% |

| Nov-2022 | Apr-2023 | 6.89% |

| May-2022 | Oct-2022 | 9.62% |

| Nov-2021 | Apr-2022 | 7.12% |

| May-2021 | Oct-2021 | 3.54% |

| Nov-2020 | Apr-2021 | 1.68% |

| May-2020 | Oct-2020 | 1.06% |

| Nov-2019 | Apr-2020 | 2.22% |

| May-2019 | Oct-2019 | 2.53% |

| Nov-2018 | Apr-2019 | 2.53% |

| May-2019 | Oct-2018 | 2.32% |

| Nov-2017 | Apr-2018 | 2.12% |

| May-2017 | Oct-2017 | 2.02% |

| Nov-2016 | Apr-2017 | 2.02% |

| May-2016 | Oct-2016 | 2.12% |

| Nov-2015 | Apr-2016 | 2.12% |

| May-2015 | Oct-2015 | 2.02% |

| Nov-2014 | Apr-2015 | 2.02% |

| May-2014 | Oct-2014 | 2.12% |

| Nov-2013 | Apr-2014 | 2.22% |

| May-2013 | Oct-2013 | 2.02% |

| Nov-2012 | Apr-2013 | 2.02% |

| May-2012 | Oct-2012 | 2.02% |

| Nov-2011 | Apr-2012 | 2.02% |

| May-2011 | Oct-2011 | 2.02% |

| Nov-2010 | Apr-2011 | 2.02% |

| May-2010 | Oct-2010 | 2.22% |

| Nov-2009 | Apr-2010 | 2.32% |

| May-2009 | Oct-2009 | 2.12% |

| Nov-2008 | Apr-2009 | 2.73% |

| May-2008 | Oct-2008 | 2.02% |

| Nov-2007 | Apr-2008 | 3.23% |

Source: U.S. TreasuryDirect

Advantages and Disadvantages of I Bonds

The primary advantage of Series I Savings bonds is their simplicity. They are issued in small denominations at face value, and their prices don’t fluctuate. The inflation-adjusted interest payment is straightforward as only the interest rate changes, not the principal value of the bond. Savings bonds are also available in paper form so they can easily be given as gifts.

A disadvantage of I bonds is the maximum annual purchase amount of $10,000 is relatively low. The $10,000 maximum makes it difficult for high net worth individuals to establish a meaningful position, although, with each family member able to purchase $10,000 per year, a steady pattern of purchasing I bonds annually will eventually lead to a sizable portfolio of inflation-protected investments.

Another disadvantage is I bonds can’t be purchased and held in a traditional or Roth IRA. The I bonds have to be held in a taxable account.

Another disadvantage of I bonds is there is an interest penalty if the bonds are redeemed in the first five years.

Series I Savings Bonds Pros and Cons

Advantages

- Simple to understand

- Issued in small denominations

- Easy to give as gifts in paper form

- Price doesn’t change with interest rates

- Composite interest rate will never be negative

Disadvantages

- $10,000 maximum annual purchase amount

- Can’t be sold in the secondary market

- Interest penalty if held for less than 5 years

- Can’t be held in a traditional or Roth IRA.

Investing In Treasury Inflation Protected Securities (TIPS)

Treasury Inflation Protected Securities are bonds whose principal value is adjusted based on changes in the Consumer Price Index. TIPS differ from I bonds in that the interest rate doesn’t vary. Instead, the semi-annual interest payment is inflation-adjusted by applying the TIPS stated interest rate when it was issued to a principal value that increases or decreases based on changes in the rate of inflation as measured by the Consumer Price Index.

TIPS Terms and Denominations

TIPS are issued for terms of 5 years, 7 years, and 30 years. The minimum purchase when issued is $100, and the maximum purchase is $5 million. The bonds are only available in electronic form. If TIPS are bought directly through TreasuryDirect, they have to be held for a minimum of 45 days.

TIPS Interest Calculation

The U.S. Treasury calculates the semi-annual interest payment on TIPS using an index ratio specific to each individual bond issue. The index ratio is also known as an inflation factor. The index ratio is multiplied by the original principal amount (also known as the face value) to get the adjusted principal balance.

The TIPS fixed interest rate is then applied to the adjusted principal balance when calculating the interest payment. The index ratio for each bond changes daily, and investors can find the most recent index ratio on the TreasuryDirect website.

The specific inflation measure used to calculate the TIPS index ratio is the non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers (CPI-U) published by the Bureau of Labor Statistics of the U.S. Department of Labor.

Each month, the CPI-U is released and the U.S. Treasury provides a new daily index ratio for the current month based on the most recent CPI-U release.

Here is an example of how to calculate a TIPS interest payment. If the TIPS was purchased at issuance for $10,000 three years ago at an interest rate of 1% and the current index ratio is 1.05, then the adjusted principal balance is $10,500. The semi-annual interest payment would be 1% x $10,500, divided by two. The annual interest payment is $105, so a semi-annual interest payment is one-half that amount or $52.50.

When TIPS mature, the holders receive the higher of the adjusted principal amount or the face value. The face value is the original principal balance when the bond was issued. Investors who buy TIPS and hold them to maturity will not suffer a loss even during an extended deflationary period when prices fall because they are guaranteed to receive the face value.

The lowest coupon rate that TIPS are issued at is 0.125%. If prevailing real interest rates are less than that, including negative rates, then the price of newly issued TIPS are adjusted upward to reflect the lower real yield. In other words, the newly issued TIPS will be sold at auction for a premium price above the face value to reflect the fact that prevailing interest rates are lower than the 0.125% coupon rate on the newly issued TIPS.

TIPS Tax Considerations

Interest received on U.S. Treasury Inflation Protected securities is taxable. The increase in the principal balance due to inflation adjustments is also taxable in the year the principal adjustment takes place even if the TIPS hasn’t matured.

Investors can avoid taxes or defer taxes on TIPS by investing through an individual retirement account. TIPS have an advantage over I bonds in that TIPS can be held in an IRA account through a regular broker. Series I Savings bonds need to be held in a self-directed IRA.

Purchasing Individual TIPS

TIPS can be bought directly at U.S. Treasury auctions or in the secondary market using a brokerage account. The secondary market has TIPS that were previously issued and have had their principal values adjusted based on the index ratio.

Investors can invest in new TIPS when they are auctioned on the TreasuryDirect website. When buying from TreasuryDirect, the investor makes a non-competitive bid. That means the investor will receive the desired amount at the interest rate that is set through the auction process.

The market price of TIPS in the secondary market will differ from the adjusted principal amount if interest rates have changed. If prevailing interest rates are higher than the stated interest on the TIPS, then the value of the TIPS will be less than the adjusted principal value.

If prevailing interest rates are lower than the stated interest rate on the TIPS, then the value of the TIPS will be higher than the adjusted principal amount.

Market prices for TIPS change so that the yield-to-maturity on the TIPS reflects prevailing interest rates. The yield-to-maturity is the estimated annualized return if a bond is held until it matures.

A TIPS’ yield-to-maturity is the estimated real annualized return for the bond if held to maturity before any inflation adjustment.

Suppose, for example, a new 5-year TIPS is auctioned at a 0.5% interest rate. Suppose there is also a 10-year TIPS that was issued at a 1% interest rate five years ago that now has five more years until it matures. In that situation, the price of the original 10-year TIPS needs to rise so that its yield-to-maturity is closer to 0.5%. That way, the investor would be somewhat indifferent between purchasing the newly issued 5-year TIPS compared to buying a TIPS that has five years until it matures.

In all likelihood, in this example, the TIPS trading in the secondary market would yield a little more than the newly issued TIPS. The reason is the existing TIPS would have an adjusted principal balance that could decline if there was a period of deflation. That could lead to a potential loss for investors, depending on the price they paid for the TIPS. Whereas, a purchaser of a newly issued 5-year TIPS would not lose money if the bond is held to maturity even if the Consumer Price Index falls for five consecutive years because the investor would receive the TIPS’ original face value.

How To Purchase An Individual TIPS Through An Online Brokers

Most online brokerages list out individual TIPS that investors can purchase in the secondary market. The TIPS listing will include several pieces of information that are critical to evaluating the Treasury Inflation Protected Security.

Here are the key pieces of information in making a purchase decision on an individual Treasury Inflation Protected Security in the secondary market using an online brokerage account. Each broker has a different format for presenting this information so you will need to review the specific broker’s glossary of terms and explanations.

Coupon

The stated fixed interest used to calculate the bond’s semi-annual interest rate.

Maturity

The date when the TIPS matures and investors will receive the higher of the adjusted principal balance or the face value.

Yield-to-maturity

This is the estimated annualized return for holding the bond until it matures, assuming that inflation doesn’t change. In other words, the yield-to-maturity doesn’t reflect an inflation adjustment because it is unknown what that will be in the future. The TIPS yield-to-maturity is also known as a real rate of return.

Break-even Inflation Rate

Investors can compare the yield-to-maturity on TIPS to the yield-to-maturity on a regular Treasury bonds that are not indexed for inflation. The yield-to-maturity on non-inflation indexed Treasuries is known as the nominal yield. The difference between the nominal Treasury yield-to-maturity and the TIPS yield-to-maturity is known as the break-even inflation rate. It reflects market participants’ expectations for future inflation. The break-even inflation rate is not listed on the broker’s website and will need to be calculated by comparing the yield-to-maturity on the TIPS to the yield-to-maturity on a Treasury bond with the same maturity.

For example, suppose a 5-year TIPS has a yield to maturity of 0.5%, and a 5-year Treasury bond has a yield to maturity of 1.5%. The difference in yield is 1%, which is the break-even inflation rate. If over the next five years, inflation comes in higher, than 1% annually than the investor in the Treasury Inflation Protected Security will make more than holding the regular 5-year Treasury. The reason the TIPS is more profitable in this example is the total cash flows received in the form of interest payments and the adjusted principal value is greater than the cash flows received on the Treasury bond.

Price

The price listed is the amount asked for the bond. The price is in the form of a factor, such as 1.05 or .98. The price factor is multiplied by the face value in order to estimate the total cost of the TIPS. The price asked can be compared with the index ratio or inflation factor for the specific bond to see if the total cost is greater or less than the adjusted principal value.

Inflation Factor or Index Ratio

Some brokerage firms will show the inflation factor or index ratio used to calculate the adjusted principal balance. If it is not listed, the investor can look up the index ratio on TreasuryDirect by using the bond’s unique CUSIP number listed on the broker’s website.

Accrued Interest

Accrued interest reflects interest due to the current TIPS holder for the time period between the last interest payment and the date of the price quote. Sometimes a broker will reflect the accrued interest in the price and designate it the adjusted price.

Estimated Total

This reflects the estimate of the total cost to purchase the TIPS, including the accrued interest. The estimated total is calculated by multiplying the original face value by the asking price factor and adding the accrued interest. For some brokers, the estimated total is calculated by multiplying the adjusted price factor by the original face value amount the investor wants to purchase. The adjusted price factor takes into account accrued interest.

The Most Important Criteria When Buying Individual TIPS

In reviewing the information needed to evaluate TIPS in the secondary market, it is understandable why some investors elect to purchase Series I Savings Bonds or only purchase TIPS at auction through TreasuryDirect. Still, it is possible to make an educated purchase decision based on the information listed.

The most important information when evaluating TIPS is the yield-to-maturity and the break-even inflation rate. The yield to maturity is the estimate of the annualized real return the investor will earn on the bond if it is held to maturity. The investor can compare that real return to the expected real returns of other investment options. Recall that the real return does not include any inflation adjustment.

The break-even inflation rate reflects the embedded inflation assumption priced into U.S. Treasury securities. An investor could buy the TIPS if she finds the yield-to-maturity attractive, and if she believes realized inflation over the remaining term of the TIPS will be higher than the break-even inflation rate.

Major Differences Between TIPS and Series I Savings Bonds

TIPS

- More complex

- Much larger purchase amounts

- Principal is adjusted for inflation

- Price can fluctuate

- Can sell without penalty

- Taxes due every year

I Bonds

- Simpler

- Limited to $10,000 maximum annual purchase

- Interest rate is adjusted for inflation

- Price stays the same

- Interest penalty if sold in the first 5 years

- Tax deferred until redeemed

Investing In TIPS ETFs and Mutual Funds

The primary advantage of buying individual TIPS, despite the complexity, is the investor will not lose money if the bond is held to maturity, That is not the case if an investor purchases a Treasury Inflation Protected Security ETF or mutual fund.

The price of a TIPS ETF like individual TIPS will fluctuate as interest rates change. As interest rates go up, the price of TIPS ETFs fall. As interest rates decline, the price of TIPS ETFs rises. TIPS ETFs and mutual funds are frequently buying and selling TIPs as new shares of the fund or ETF are created and redeemed. That means the TIPS ETF or mutual fund investor could suffer a short-term loss if interest rates rise. The loss could be large enough to offset any potential inflation protection benefits.

If the TIPS ETF or fund is held for 7 to 10 years, the loss due to rising interest rates can usually be recovered as the mutual fund and ETF invests in higher-yielding bonds.

All TIPS ETF or mutual funds publish their SEC yield and duration. The SEC yield is an estimate of the fund or ETFs yield-to-maturity less expenses such as the management fee. How the SEC yield for TIPS is displayed depends on the ETF sponsor. For example, Vanguard’s SEC yield for its VTIP ETF doesn’t reflect any adjustment for inflation. The SEC yield is the real yield to maturity less fund expenses. iShares on the other hand incorporates the TIPS inflation adjustment in its calculation of the SEC yield. The result is iShares TIPS ETF SEC yields will always be considerably higher than Vanguard’s SEC yield for its TIPS ETFs. The Vanguard method is preferred because it is more straightforward.

The duration is the fund or ETFs price sensitivity to rising interest rates. The longer the duration, the more the TIPS vehicle will fluctuate in price as interest rates change.

Investors in TIPS funds or ETFs should compare the SEC yield and duration of various ETF and fund options to see how much income they will receive relative to the potential interest rate risk.

The benefit of TIPS ETF and mutual funds is they are simpler to purchase than buying individual TIPS issues, although there are additional expenses that get paid to the fund or ETF sponsor.

TIPS ETF Examples

Here are some examples of ETFs that invest in Treasury Inflation Protection Securities. You can find our analysis and review of the Quadratic Interest Rate Volatility ETF (IVOL) here.

The following are affiliate links, if you click and make a purchase we may earn a commission at no additional cost to you.

-

Learn More

Learn More

This is an affiliate link, if you click and make a purchase we may earn a commission at no additional cost to you.

-

Learn More

Learn More

This is an affiliate link, if you click and make a purchase we may earn a commission at no additional cost to you.

-

Learn More

Learn More

This is an affiliate link, if you click and make a purchase we may earn a commission at no additional cost to you.

Pros and Cons of TIPS Investing

Advantages

- Ability to invest large sums

- Multiple ways to invest

- Highly liquid

- Inflation protection

Disadvantages

- Complex

- Taxes due every year

- Real yields can be low

Conclusion

Owning inflation-indexed bonds, such as U.S. Treasury Inflation Protected Securities or Series I Savings Bonds, is the safest and most straightforward to way to get inflation protection because the holding returns are directly impacted by the changes in the Consumer Price Index.

Because these bonds are so safe, the real yields are low. For TIPS the yield-to-maturity can even be negative before any inflation adjustment. Still, TIPS and I Bonds can be an attractive and secure way to protect a portion of investors’ assets from inflation.

What to read next

A Complete Guide to Understanding and Protecting Against Inflation

How To Invest In Bonds and Other Fixed Income Securities

IVOL ETF Analysis and Review

David Stein is the founder of Money for the Rest of Us. Since 2014, he has produced and hosted the Money for the Rest of Us investing podcast. The podcast reaches tens of thousands of listeners per episode and has been nominated for ten Plutus Awards and won one. David also leads Money for the Rest of Us Plus, a premium investment education platform that provides professional-grade portfolio tools and training to over 1,000 individual investors. He is the author of Money for the Rest of Us: 10 Questions to Master Successful Investing, which was published by McGraw-Hill. Previously, David spent over a decade as an institutional investment advisor and portfolio manager. He was a managing partner at FEG Investment Advisors, a $15 billion investment advisory firm. At FEG, David served as Chief Investment Strategist and Chief Portfolio Strategist.